5 Ways Coronavirus has Changed Media: Media Buying Becomes More Flexible

This week, we’re looking back at the almost five months since the WHO declared the COVID-19 outbreak a global pandemic on March 11, 2020. So much has changed. There are still more questions than answers. And several trends have emerged that have helped us understand how the coronavirus has changed media, how the coronavirus has changed consumer behavior, and how the coronavirus has changed real estate.

Media Buying Becomes More Flexible

We’ve already talked about how digital first is finally here, the benefits of programmatic audio, and why direct mail for real estate may make sense, especially when done in conjunction with targeted digital advertising. Today, we’re going to look at how ad spend has changed during the pandemic and how traditional media buying has been forced to move toward a more flexible model, reminiscent of digital.

The End of the Upfront

Upfront advertising means buying ad space well in advance of when ads will actually run (typically months in advance). The upfronts are a series of events, mostly presentations and celebrity-filled parties, that the major television networks have held for decades, since ABC held the first upfront in the early 60s when the Mad Men era was born. A huge amount of advertising is sold during the upfronts – 75% or more of each network’s programming for the year to the tune of billions of dollars – not because television programming has gotten better (the opposite is true outside of streaming services), but because the networks are incredibly good at selling scarcity. Since there are a limited number of ad spots available on the best primetime programs, as an advertiser you’d better buy early or you’ll be locked out.

For decades this worked extremely well. Networks even held on as people spent more time with digital than TV and advertising followed them online, though they held on mostly by adding their own digital options. Now, what was already a steady decline has become a massive exodus with advertisers planning on spending one third less in this year’s upfront and even that may increase as the upfronts have been put on pause.

Less Money for TV, More Competition for Digital

Why does this matter? Disrupting the TV ad buying process will likely have a ripple effect, benefiting other types of ad buying, including digital, and resulting in more of a democratization of TV advertising itself. Opportunities may arise for small businesses to experiment with broadcast TV without the exorbitant costs and long-standing exclusivity that has virtually shut them out in the past. As AdWeek writes, “some marketers are debating skipping the upfront in favor of executing flexible, cost-effective programmatic buys in the scatter market.” The scatter market is where brands buy TV spots on a short term, typically month-to-month or quarterly basis, and it can benefit advertisers as networks are more likely to make deals at the last minute to fill unsold inventory.

Even with more flexible TV buying models, according to consulting firm Advertiser Perceptions, most marketers said they could replace the reach of traditional TV ads with those in streaming services or via digital video ads. And advertisers looking to shift dollars online will increase competition for online ad inventory, which has seen competition decline and pricing drop during the pandemic, even amid record traffic growth. This means companies looking to take advantage of digital advertising to monetize the shifts in media consumption should jump on it now, before advertisers looking to re-allocate upfront budgets start buying premium digital placements.

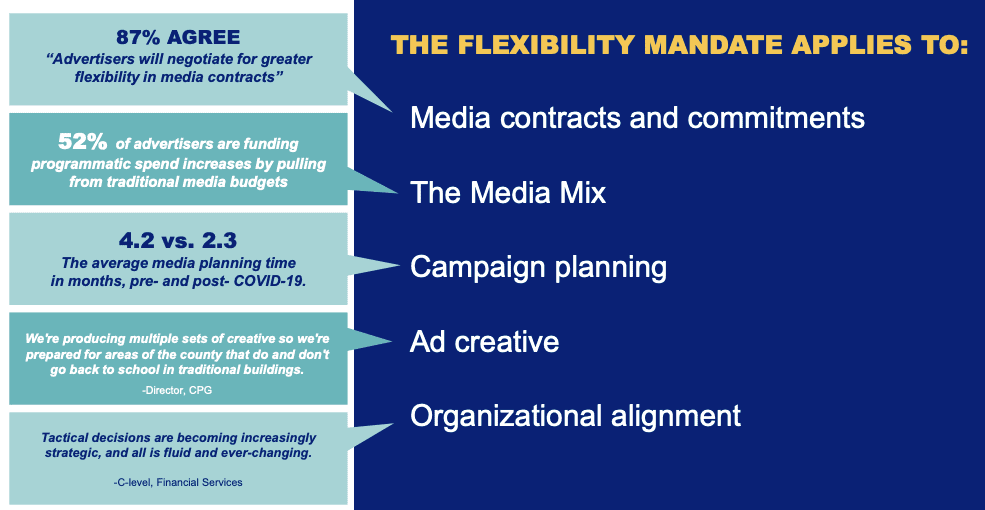

With Uncertainty, Flexibility is Key

TV still commands huge advertising budgets – with production and advertising costs often exceeding $350,000. Big brands have been pushing for changes to the upfront buying model for a while, but networks have still seemingly held the upper hand, even despite declining viewership, few targeting capabilities outside of the programs themselves, limited measurability of ad effectiveness, and other challenges. Connected TV, over the top (OTT), premium streaming services, and video and social platforms have been on the rise for years and broadcast TV still commands massive reach. This year could be the year that changes, however.

Research done early in the pandemic showed 61% of marketers altering their short-term media strategy though only 9% were making long-term changes at that time. Yet even for those not planning long term changes in Q2, the vast majority of advertisers expected to be met with flexible solutions from the media outlets where they had planned to run ads.

It’s All About Value

More so than ever, performance marketing is most advertisers’ primary focus. Companies need to see a return on their investment and there’s too much uncertainty to know what customers will need and how companies can best reach them in the near future. Planning has literally gone from years in some cases to days.

Advertisers’ biggest concerns are what consumer behavior will look like after stay-at-home orders expire and amid concerns about a second wave of the virus, as well as changes to programming if (or as many believe, when) live sports and other events are canceled. Planning to run a TV spot, even supported by a digital campaign, on ESPN looks very different now than it did a year ago.

For the businesses paying attention, and that are ready to act within hours to launch a new campaign, opportunities abound. According to Alastair Shearly-Sanders, President of advertising agency Amplifi at Dentsu Aegis Network, “There has been a general softening in all pricing with the simple economics of less money in the market, whether that is traded through auction or not.” “Clients and agencies have always sought the best way to invest,” says Shearly-Sanders. “Any move towards business outcomes and what constitutes value to the advertiser will need to be managed as effectively as before. We expect to see brands focus more on bespoke strategies that align to revised business objectives, and so will seek out more flexibility in the way they procure media.”

As Jeff Bezos recently said in a shareholder meeting, instead of asking how you can make long term plans now, “I would always encourage people, when they think about 10 years, to ask the question, what won’t change?”. The same applies when thinking about 10 days from now. Being prepared for change means being prepared for new opportunities, of which now more than ever there are many, and knowing that the opportunities of tomorrow will look different than those of today.

This post is part four of a five-part series that highlights how Coronavirus has changed media.

Read Part 1: Digital First is Finally Here

Read Part 2: Programmatic Audio’s Heyday

Read Part 3: The Direct Mail Opportunity

Read Part 5: Performance Marketing Takes Center Stage