Here Come the Transactions

I come from a long line of people that are exceptionally good at repeating themselves.

My grandmother was legendary. She would repeat stories so often, before she didn’t realize that she was repeating stories so often, that I can recite them word for word with the same intonation. My dad is a close second.

Having grown up around this, what I try to do when repeating myself is at least be a little bit more conscious of when I may be telling you a story you’ve already heard. Over the past three weeks, I have repeated (over and over again) that the COVID-19 winter is like 9/11 or Pearl Harbor, a singular event that will change the way we live, think and work.

I also have said that the time we are all spending at home will lead to a tremendous amount of real estate transactions: people will be evaluating where they’re living and making a lot of moves on the other side of Stay At Home orders that are covering half the world right now.

When you repeat yourself, it feels good to have outlets like The Washington Post saying the same thing. They sum up the beginning of this phenomenon quite well in a piece called “The Great American Migration of 2020” – which inspired this post.

No, everyone is not looking for survivalist real estate. As I’ve been saying … I would not want to own a lot of commercial property right now, because not everyone will just go back to the office after the pandemic is over. Once people have shown they can work remotely effectively, there are a lot of reasons a remote workforce benefits both the employer and the employee.

There are two markets that I think line up well in the post-COVID market.

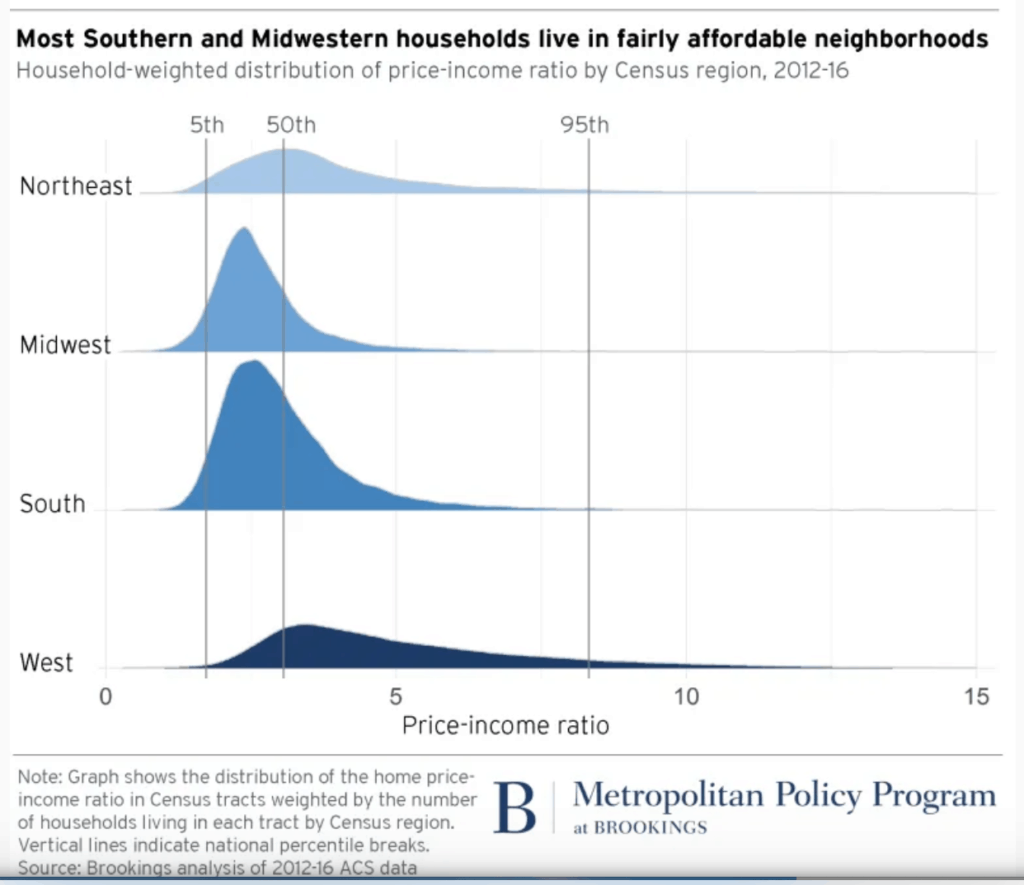

The “near-far”: The cost of housing in urban markets, especially on the coasts and Northeast, has made city-living really expensive. Here’s a graph from the Brookings Institute that shows a housing affordability curve that’s about to be flattened:

I believe that the outer suburbs of major metropolitan areas (from New York’s Hudson Valley to Fairfield & Litchfield counties in Connecticut or the North Shore of Boston, just to name a few examples) will see a big increase in demand.

The pendulum was ready to swing back in the direction of these markets known for their great schools and good proximity to the city. Downsizing baby boomers and urban-centric millennials have been fighting over the same real estate for years: driving up the prices of walk-centric properties in more densely developed suburbs. Even in the same town, the price-per-square-foot of homes that don’t fall within the “walkability to the train station” range are a fraction of those that do. In the past weeks, the outer suburbs of New York City have seen a huge increase in demand, including one rental in Greenwich that received 60 inquiries on the first day. If you can work remotely and only need to go into the city a day or two a week, a ten-minute drive to the train station is no big deal.

Destination Vacation Markets: I wish I had a $1 for every time I’ve heard someone on the chair lift say they would “move to Vermont if they could find a job …” What they’re really saying is that they don’t want to move to Vermont, they want to move to the destination vacation parts of Vermont that they come to every weekend (big difference). Once you’re able to work remotely most of the time, towns like Stowe, Wolfeboro and Hyannis are great places to call home and still be reasonably accessible to major northeastern cities.

While everyone is sheltering in place, we’re seeing clients in destination markets receive huge traffic spikes on their websites. Depopulating northeast states already have huge incentives ($10K to move to Vermont and college loan repayment from the state of Maine) for people to relocate. COVID-19 may be real estate’s second coming of 9/11, which lead to 2 million people leaving the NYC area over a ten year period.

All of this migration will lead to a lot of transactions. This comes in stark contrast to the recent past, where the American homeowner had spent five years more in their current home, on average, than they did in 2010. Like every industry, real estate is virtually frozen due to the current stay at home orders and yet I continue to believe the spring market that follows the COVID-19 winter will be a good one.