5 Ways Coronavirus Has Changed Digital Marketing for Real Estate: Bidding, Explained

In the five months since the WHO declared the COVID-19 outbreak a global pandemic, several trends have emerged that illustrate how the coronavirus has changed media, how the coronavirus has changed consumer behavior, and how the coronavirus has changed real estate. This week, we’re diving into where these intersect – how the coronavirus has changed digital marketing for real estate – and as real estate professionals how you can thrive, and not just survive, in the “COVID era”.

So far, we’ve highlighted the importance of and tips for effective local marketing for real estate, building rapid response into everything you do, and meeting your customers’ increasingly high expectations. Today we’re going to look at a different side of digital marketing for real estate – the buy side.

Bidding, Explained

The first online banner ad appeared in 1994. For over a decade, ads were bought at a fixed price and negotiated directly between the buyer and seller, just as media has been bought and sold for hundreds of years. Then in 2009, real-time bidding (RTB) was introduced and changed everything. Real-time bidding essentially democratized online ad buying, letting advertisers choose how much to spend for ads in real-time, through an auction-based bidding process, based on criteria like the time of day and day of week, where the ad was appearing, and in front of whom the ad was appearing. Then in late 2014 through the summer of 2015, the term header bidding entered our lexicon. AdTechies had figured out that Google’s RTB algorithms favored bids from Google’s ad exchanges and promoted header bidding, once called advanced bidding and pre-bidding, as a way for web publishers to simultaneously offer ad space out to numerous ad exchanges at once, maximizing revenue.

You may be wondering, what does this have to do with digital marketing for real estate? While the economics of how media is bought and sold online are often overlooked, they’re hugely beneficial in understanding trends and tactics to maximizing marketing return on investment (ROI).

When the Highest Bidders Aren’t Winners

Google, Facebook, Amazon and other major media platforms still use auction-based real-time bidding today to decide which ads are shown to which users, in which placements, and when. While online advertising can still be bought on a cost per thousand impressions basis (CPM), the popularity of performance marketing has lead to cost per result pricing being used widely, including cost per click, cost per view, cost per engagement (such as a like or share), cost per acquisition, cost per lead, cost per purchase, cost per order, or cost per sale. Google, Facebook and others typically use these factors to determine which ads will show and in which position (which ads win the auction):

- Bids – what the advertiser is willing to pay.

- Estimated engagement (click-through rates, action rates, etc.) – though the specifics vary by platform, with performance-based pricing Google, Facebook, and other publishers only make money when a specific result is achieved (an ad is clicked, a user engages, a lead is generated, etc.). Their goal is to make money so if an advertiser has a maximum bid of $1, but data indicates their ad is more likely to achieve the desired result than a different advertiser’s ad with a $1.50 maximum bid, Google, Facebook, etc. will give the prime ad spot to the advertiser bidding $1. Because making $1 is better than making nothing.

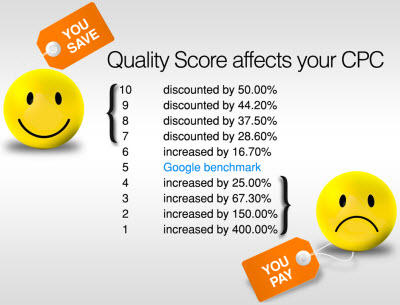

- Ad quality – this is handled differently on different platforms as well. Google, Facebook, and others all have quality indicators that influence which ads win specific auctions and get premium placement. Typically, ad quality is measured by ad and landing page engagement – quality score is how Google measures landing pages (numerically from 1 to 10, which 10 being best) and it’s impacted by how people have behaved historically, for example, do they stay on the page after they click through, and how relevant ad and landing page content are deemed to the user. Facebook uses other indicators like how much text is in an ad to determine quality, using its massive data on what the best performing ads look like and comparing each ad accordingly.

With performance marketing, the highest bidders will lose impression share (the total number of chances your ads have to win auctions), sometimes not showing at all, or will appear in non-premium placements (below the top of the page or after page one) unless they’ve prioritized developing highly engaging and relevant advertising experiences. From ad copy to graphics to the landing page a user is directed, everything needs to be optimized for both the ad platform and the user to maximize ad visibility.

CPLs are Going Down

At Union Street Media, our goal is to consistently drive our clients more value for the same spend, even recommending spend reductions when performance supports it. For savvy brands, there’s never been a better time to allocate as much as possible to digital. Because of the factors above – ad and landing page quality – and the way online advertising works, prioritizing great content and seamless user experiences means you’ll pay less for the same eyeballs, and the same clicks, as others.

That was before the pandemic. Now, because of the coronavirus, competition is far lower than it’s been in recent memory. Online traffic skyrocketed when stay-at-home orders began in March and continues to remain high, but reductions in total advertising spend (digital has been affected, though not nearly as much as TV, radio, print, and out-of-home advertising) have created a surplus of inventory, driving pricing down. In fact, web publishers are seeing drops of up to 47% in cost per click prices. Some publishers, like YouTube, have responded by introducing new ad options and creating more ad space, which may only exacerbate the inventory surplus and help keep pricing low (though with YouTube’s scale, it’s clearly banking on making up for lost ad revenues in total volume). Regardless, the current environment is creating an ideal opportunity for real estate brokerages and agents to acquire new customers at lower costs than previously expected. Savvy marketers will focus on developing great content, target it to hyper-local audiences, adjust bidding strategies to come in well below pre-COVID levels, and watch their costs per lead tick down – we saw a 37% decrease in cost per lead for our clients’ paid search campaigns in Q2. I’d expect to see the same trend continue in Q3.

This is part four in a five-part series all about the Ways the Coronavirus Has Changed Digital Marketing for Real Estate.

Read Part 1: The Homebody Economy

Read Part 2: Beyond Leads

Read Part 3: Consumers Expect More

Read Part 5: Opportunities Abound